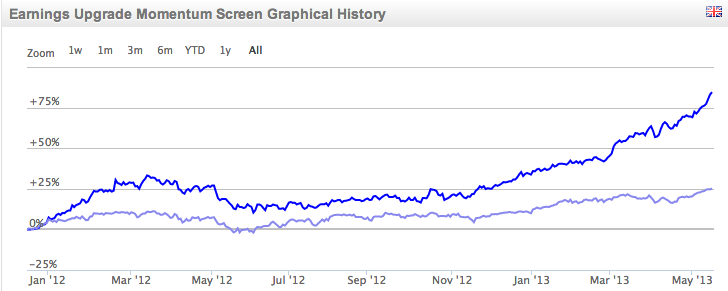

While the opinions of brokers often attract legitimate scepticism among investors, there’s little doubt that anyone keeping an eye on our analyst upgrade screen recently would have been impressed. Of all the investing strategies we track here at Stockopedia, the Earnings Upgrade Momentum screen has wiped the floor with most of the others and, unlike some of the other best-performing screens, it comes with decent levels of diversification to boot. Over six months it has returned a startling 55.6% against a healthy gain of 17.8% in the FTSE 100, which ties in with the performance of a similar AAII screen which has trounced the index for over a decade. So what’s causing these impressive screen returns?

Who cares what brokers say?

A glance over the decades of research into the impact that broker research can have on stock prices reveals that investors need to tread carefully, particularly if you are thinking of trading on ‘buy’ and ‘sell’ recommendations. Despite the way you see broker recommendations bandied around by bulls on bulletin boards, the research shows that the price impact of new ‘buys’ and ‘sells’ is sudden and short-lived – and because of the bias inherent in much broker research, sometimes analyst buy recommendations are best used as a contrarian indicator!

However, a strategy based on trading on changes in broker estimates, rather than recommendations, is supported by much more promising research. This is likely to do with freshness. Barber et al found that nearly 50% of all recommendations are left unchanged when they are revisited, approximately 300 days after they were first made. Earnings forecasts, in contrast, are generally more responsive to short-term news events (being revised on a quarterly or even monthly basis).

Among the most compelling research that found in favour of earning upgrades was a 1996 study by Phillip McKnight and Steven Todd. They assessed the revision anomaly across Europe and found that stocks with the greatest number of upward revisions in earnings, net of downward revisions, achieved significantly higher returns than otherwise similar stocks. They tracked a portfolio of shares in the highest 20% of net upward revisions and found that it outperformed the bottom 20% of upward revisions by more than 16% annually.

McKnight and Todd concluded that an EPS revisions strategy worked so effectively because ‘bad news travels quickly, but good news…