Events/Publications

Firstly, WH Ireland publish an interesting shares magazine every month, called WHI-Spy, which contains news & views on shares.

I find it an interesting read, and hence am happy to pass on the link here each month when it's published, so click here to read the April 2013 edition (no registration required).

Secondly, Master Investor have contacted me to offer some free tickets to readers here, which I'm happy to pass on. Click here and enter promotional code PP2013 to take up this offer. It's on Sat 27 April, in Islington, London. I shall be attending, so hope to see some of you there during the day. The blurb for the event is;

Master Investor 2013 will be held at the Business Design Centre in Islington, London, from 9am on Saturday 27th April. Organised by t1ps.com and now in its 11th successful year, the show features a unique line-up of top speakers, along with the chance to meet with over 100 top company executives, discuss investment opportunities and gain unique investment insights you won’t find anywhere else. For more information visithttp://www.masterinvestor.co.uk

Pre 8 a.m. comments

There is an interesting announcement from Deltex Medical (LON:DEMG), which is on my watch list following a recent presentation to investors by their CEO. It concerns the granting of a "unique ODM payment code" by the USA Govt, so that physicians will receive automated reimbursal every time they use one of Deltex's products in surgery.

I'm not going to pretend to understand the sector, but based on what the CEO said at the investor meeting I attended, then this sounds like pretty significant news. He asserted that their product improves results from surgery by bettering monitoring fluid levels in the patient, but that it was proving difficult and slow to commercialise.

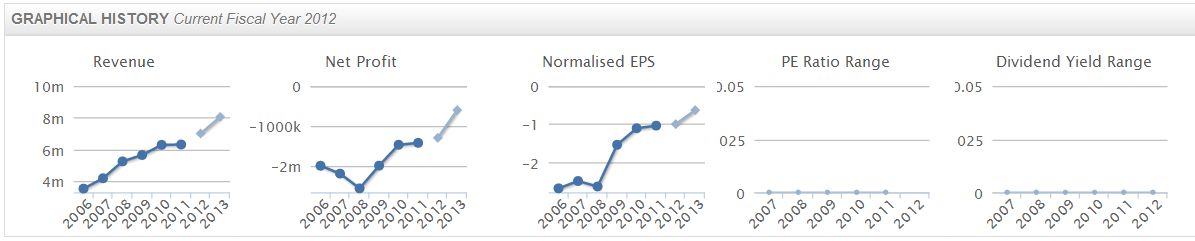

As you can see from the historic revenue chart above (where the lighter coloured lines are forecast), revenue has been stuck around the £6m level for the past four years. Perhaps this deal might give the company the impetus it needs to drive sales higher. It's a fairly high margin product too, so stronger growth could well take them into profitability. I've just bought a few at 14.38p, the £20m market…