Pre 8 a.m. comments

Good morning! Fairly quiet today, as it usually is on Fridays, but there are a few interesting announcements to flag up.

Games Workshop (LON:GAW) have issued a refreshingly brief IMS for the period from 3 Dec 2012 to 7 Apr 2013, which looks a rather strange period, but given that their year end is 3 Jun 2014, this represents their second half (H2) to date, i.e. four months. They simply say that, "trading has been broadly in line with the board's expectations", so slightly below then.

I will buy shares in the first company to issue a trading statement which actually says "slightly below" instead of "broadly in line", as that would demonstrate putting honesty before spin.

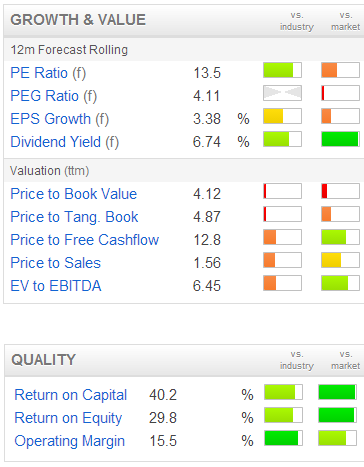

Stockopedia shows broker consensus for this year as being 47.6p EPS, down from 50.8p last year, which translates to a PER of 14.1 (an Earnings Yield of 7.1%). The dividend is forecast at 45p, meaning that almost all earnings are being paid out in dividends, for an attractive but barely covered dividend yield of 6.7%.

Note how useful the Earnings Yield is (it's the inverse of the PER. So in this case where the share price is 673p and EPS is 47.6p, then the PER is 673/47.6 = 14.1.

Flip those round to calculate the Earnings Yield, which is EPS of 47.6p/673p share price = 7.1%.

Why bother using earnings yield? Well because you can then compare it with the dividend yield of 6.7%, and instantly see by comparing the two figures what the dividend cover is. I think that's so useful, that I'll be mentioning earnings yield from now on.

You can also then compare company valuations with any other asset class (e.g. Bonds, property, cash in the bank), pretty much all of which are expressed as yields, rather than price multiples of yield.

GAW looks like a mature business to me, and the shares have done well in the last year, so I doubt there is much (if any) upside on the current share price for the time being, so it doesn't interest me. Although I do note the strong green bars in the "quality" section above, indicating quite a high operating margin, and good return on capital employed.

Regenersis (LON:RGS) announce a small bolt-on…