Pre 8 a.m. comments

A fairly quiet day for results today, after an absolute deluge yesterday. As usual I'll take a quick look at the most interesting (to me) results and publish just before 8 a.m.. Then a more leisurely look at a few more companies between 8-10 a.m..

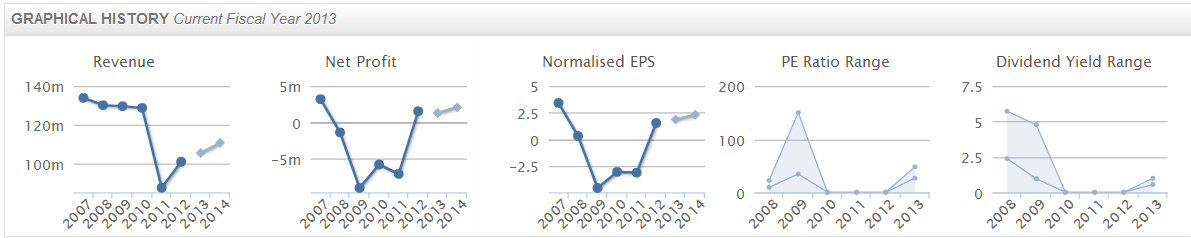

Given my retail background, I'm drawn to today's results for the 52 weeks to 26 Jan 2013 from Moss Bros (LON:MOSB). Performance is expected to be good, as the share price has already factored in rather too much recovery for a business that has struggled to be profitable for several years now.

At 66p and with 99.3m shares in issue, the market cap is £65.5m.

Basic EPS rose from 1.63p to 2.43p, so that puts them on a lofty rating of just over 27 times. The total dividend for the year has been more than doubled, but is still only 0.9p, for a yield of only 1.4%. Put another way, the quoted bid/offer spread would consume over 2 years dividends!

Although the 2.43p EPS figures seems to be well ahead of broker consensus forecasts of 1.88p.

MOSB have a particularly strong balance sheet, with £25.7m in net cash, although that is likely to be at/near a seasonal peak at the year-end date. Current assets total £44.2, and current liabilities are only £15.9m, so there is a very healthy working capital surplus of £28.3m. Long term liabilities are only £7.5m, so working capital less all liabilities is a very solid £20.8m.

This is important, as a strong balance sheet means the company is not likely to go bust - de-risking the investment for shareholders, and giving potential upside if something good is done with surplus cash (e.g. a special dividend, buybacks, acquisitions, etc). Cash also gives suppliers confidence, giving you the pick of the best suppliers & stock, and it means you can use your financial strength to increase profit, by e.g. paying suppliers cash on delivery if they give you a discount.

I note from the narrative that they are looking at refitting 90 stores over the next 5 years, so the business will be capex hungry, and cash could decline. Although it's also worth noting that EBITDA of £7.9m last year is considerably higher than PBT of £3.0m, which implies a fairly hefty depreciation charge of…