It's quite a daft premise really but, in general, constructing a portfolio full of stocks that have risen the most over the previous year or so gives you the highest probability of making a profit in the coming months. Between the end of WWII and 2008 a strategy that went long recent winners and short recent losers (i.e. top and bottom 10% of stocks ranked by 1 year price performance) returned an annualised 16.5% with remarkably low volatility. So strong is the return to these long-short momentum strategies and so universally is it witnessed across sectors and asset classes that billions are allocated to it by fund management groups globally.

Victor Niederhoffer, the famous quantitative trader, once poetically described statistical trading strategies such as this as 'like collecting nickels and dimes in front of a steamroller'. Indeed, hidden within the smooth and strong profit line of this momentum strategy lurks a black swan with a nasty bite. It displays what is known as 'negative skewness' - every once in a blue moon profits from the strategy completely and utterly collapse, wiping out careless traders in the process.

What happens in a momentum crash

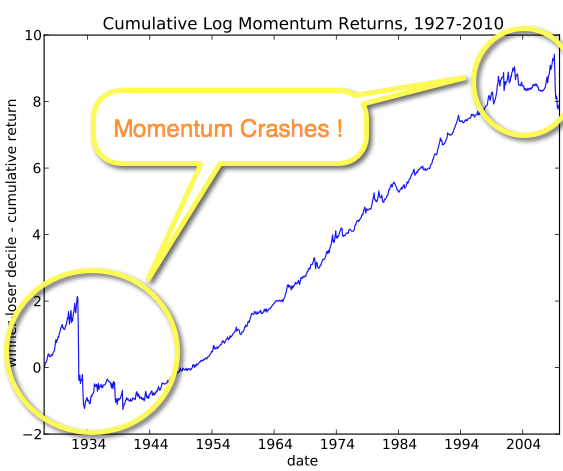

In April 2011 Kent Daniel published the research paper '*Momentum Crashes' to investigate this phenomenon. A long-short momentum portfolio is created by going long the 10% of stocks with the strongest previous 12 month performance (winners) and short the 10% of stocks with the weakest (losers). He discovered that since 1926 there have been several periods during which the profits from this 'winner minus loser' strategy dramatically crashed, most notably March to December 2009 and the period from 1932 through to the end of World War II.

In normal times the winner portfolio outperforms the loser, but during such a momentum crash the loser portfolio massively outperforms the winners. Daniel illustrated this with the fact that over the 3 months between March and May 2009 the winner portfolio rose by only 6.5% but the loser portfolio (or the stocks that had collapsed the hardest in the financial crisis) rose by 156% ! Anyone short the losers clearly had a miserable time and probably went bust in the process.

Essentially, what is happening in a momentum crash is that the worst performing stocks in the market, the losers, rebound dramatically more quickly than the winners.

Thus to the extent that the…