Pick up an exclusive 14 day free trial and £50 discount code.

Have you ever had an investment idea and needed to check a company's fundamentals fast? Did you find navigating company reports laborious, time consuming and frankly boring? We did too, and decided to give investors all the key analysis and information needed to make a decision on a single visual page.

Our goal is to deliver powerful analytical algorithms as simple visual tools so that you reap the benefits as an investor.

At the core of Stockopedia's offer are 2000+ Company Profiles elegantly presented with all the essential metrics investors need to make decisions.

"...gloriously designed...the individual company pages on Stockopedia are an absolute delight and incredibly easy to read... featuring a huge range of valuation metrics... powerful, professional grade measures..."

Stockopedia’s unique ‘Traffic Light’ system shows instantly whether a company's fundamentals are attractive compared against its sector peers or the market as a whole. With a focus on key Growth, Value and Quality indicators the TrafficLights™ provide an instant shorthand to improving your share selection and stockpicking. Data Visualisation at its most intuitive.

Could the stocks you own be at risk of bankruptcy? Is there a high probability that the accounts have been manipulated? Or is the company turning around from a poor situation? We help answer these questions instantly. We have turned high end academic research papers into intuitive and easy to use indicators making Stockopedia's company pages the best research tool for the UK stockmarket.

"The Stockopedia Premium service ... presents all the data on any UK company that you are likely to want and hence saves you doing the analysis... this is a highly recommended service..."

Instantly discover whether a company is qualifying for deep value screens, growth strategies or as a momentum play. We apply our screens every night to label every stock in the market with the strategies it qualifies for. At a glance you can see whether investors of a certain style will be interested in your stock.

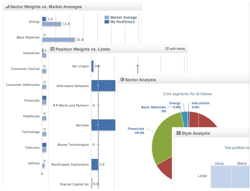

Every investor's first obsession is how to pick a great stock. But many overlook the impact that constructing a well diversified portfolio can have on increasing their overall returns while reducing their overall risk. Joining Stockopedia will give you access to portfolio tools that help you make the most out of your investments and give you the bird's eye view you need on your overall stock portfolio.

"Impressed not only by the usability of the data, but also by the range of checks that the company was subjected to, including risk indicators such as the Piotroski F-score and the Altman Z-score that are so helpful in identifying potential ‘red flags’”"

If you have a stock you are interested in, load it into the Checklist Tool and click an Expert Screening Strategy to compare it against. You'll see the list of investment criteria and whether the company in question passes or fails against each. It really is that simple to determine how closely a stock matches up against an investment strategy. We have preloaded the checklist tool with dozens of expert strategies allowing you to instantly find the potential flaws in an investment idea.

Have you ever wanted to know how much a stock would be worth if it hit its growth projections? Or how much might be left for shareholders in a liquidation? Whether you prefer to compare valuations of stocks relatively against their peers, use discounted cash flow valuations or asset based balance sheet valuations, our valuation toolkit ensures that you have the important bases covered.

Many of the world's greatest investors were also prolific writers. Indeed, the fame of Warren Buffett, Benjamin Graham, Joel Greenblatt, Jim Slater and Joseph Piotroski endures and spreads through their articles, letters and books.

We have derived discrete sets of quantitative criteria from books & articles by or about these investors. By screening the market based on these criteria, we generate actionable lists of qualifying stock ideas to save you hours of initial research. By tracking the performance of each strategy we are figuring out what works in the stock market.

"... Since I last wrote about advanced screeners for UK value investors, the kind you have to pay for, Stockopedia has emerged as my favourite.... For data, Stockopedia shines.""

Richard Beddard, Interactive Investor

To make sure you aren't blindsided by the guru glitz factor and to ensure that these strategies really perform, we track the returns of all our modelled strategies daily. With simple to understand performance charts versus the market and key risk factors tracked such as maximum drawdown and Sharpe ratios you can be sure that you are getting ideas from solid investment styles.

If you like to dig where others don’t? Our powerful stock screening tool can be customised with any combination of 150 different investment metrics. Data mine to your heart’s content to find the opportunities that others miss. You can even 'duplicate' our guru screening criteria and create your own versions. Coming soon - track and publish your screening strategies!

“One of the advantages of using Stockopedia is that it helps throw up companies that you would otherwise not find out about. It also helps investors avoid getting caught in the traps that even the biggest household name shares can lay.”

Simon Lambert, Mail Online

Our team at Stockopedia consist of an obsessive group of like minded individuals who are dedicated to finance, programming and education. The distillation of our research is published in our series of easily read e-books. We have summarised the literature of the legends of finance - from Gurus like Warren Buffett and BenjaminGraham to modern academic pioneers like Joseph Piotroski or Messod Beneish. We've learnt far more doing this than we did at the blue-chip financial institutions we used to work in!

"I judge investment books mainly by incremental knowledge per unit time. How much do I learn from the book, and how long does it take me to read? This slim volume from the Stockopedia team satisfies this criterion. It succinctly reminded me of lot of what I already know, and told me a few things that I didn't!"

Guy Thomas, Author of Free Capital

Stockopedia's research process starts by summarising the world's best stock picking strategies into bite-sized 1000 word articles. We stay current with academic research into stock markets while delving into the bestselling classics of finance found regularly in home bookshelves. These summaries save subscribers hours in reading time and are organised into series.

We syndicate the best articles, documents and webcasts from the blogosphere and investment research houses every day. Every article is categorised by company ticker allowing easy discovery from company pages or from portfolios. Our aim is to bring the best of the web to you.

We host over 150,000 news articles from sources such as the LSE's Regulatory News Service (RNS), Reuters News and PRN Newswire. The history surrounding stocks and the stories behind them is essential to qualitative analysis - start and end your research at Stockopedia.