Market Musings 270424:

Time to focus on Deep Value?

- Podcast: Ramping up investment in electricity transmission infrastructure

- Bonus podcast: Ther Meb Faber show - GMO’s Catherine LeGraw – Capitalizing on Global Asset Allocation in 2024

- Global stock markets rebounded last week: Euro STOXX 50 and S&P 500 now only 2%-3% off end-March highs. Nikkei 225 has corrected more, but is also bouncing;

- Despite the surge in long-term interest rates (bond yields) since the end of 2023;

- High risk assets: Nasdaq 100 index rebounds post strong quarterly results from Microsoft, Google, but Bitcoin continues to mark time around $63,000;

- Precious metals: Setback for gold and silver after a breakneck run since March - but breakouts to new highs are intact

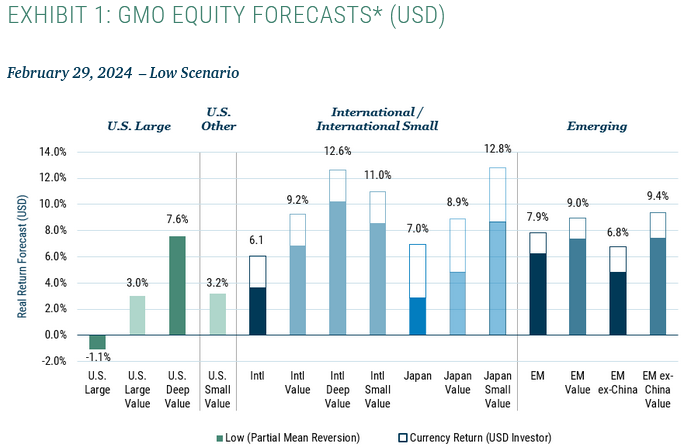

- Deep value is a very attractive long-term investing opportunity now, according to GMO

1. Major stock indices rebounded last week, Euro STOXX 50 only 2% off recent high

Source: tradingview.com

2. In spite of the pressure from rising long-term interest rates

Source: tradingview.com

3. High-risk assets: Mega-cap tech rebounds on the back from strong quarterly results at Microsoft, Google

but Bitcoin marks time $10,000 below the recent all-time high

Source: tradingview.com

4. Setback for gold and silver after a breakneck run since March - but breakouts to new highs are intact

Source: tradingview.com

5. GMO (Grantham, Mayo and van Otterloo - US value fund managers) are big fans of deep value inside and outside the US

Despite strong gains in equity markets last year and year-to-date as well as indexes sitting at all-time highs, we are extremely excited about the investing landscape from an asset allocation perspective. An abundance of cheap assets underpins this enthusiasm from an absolute return standpoint, while appealing valuation spreads within asset classes present us with the best relative asset allocation opportunity we’ve seen in 35 years.

GMO argue that it is time to buy Deep Value in global stocks

First of all, a disclaimer. Since GMO is a US value fund manager, they are clearly talking their own book when arguing the case for investment in value stocks.

However, note their long-term (7-year) expected real return forecasts…