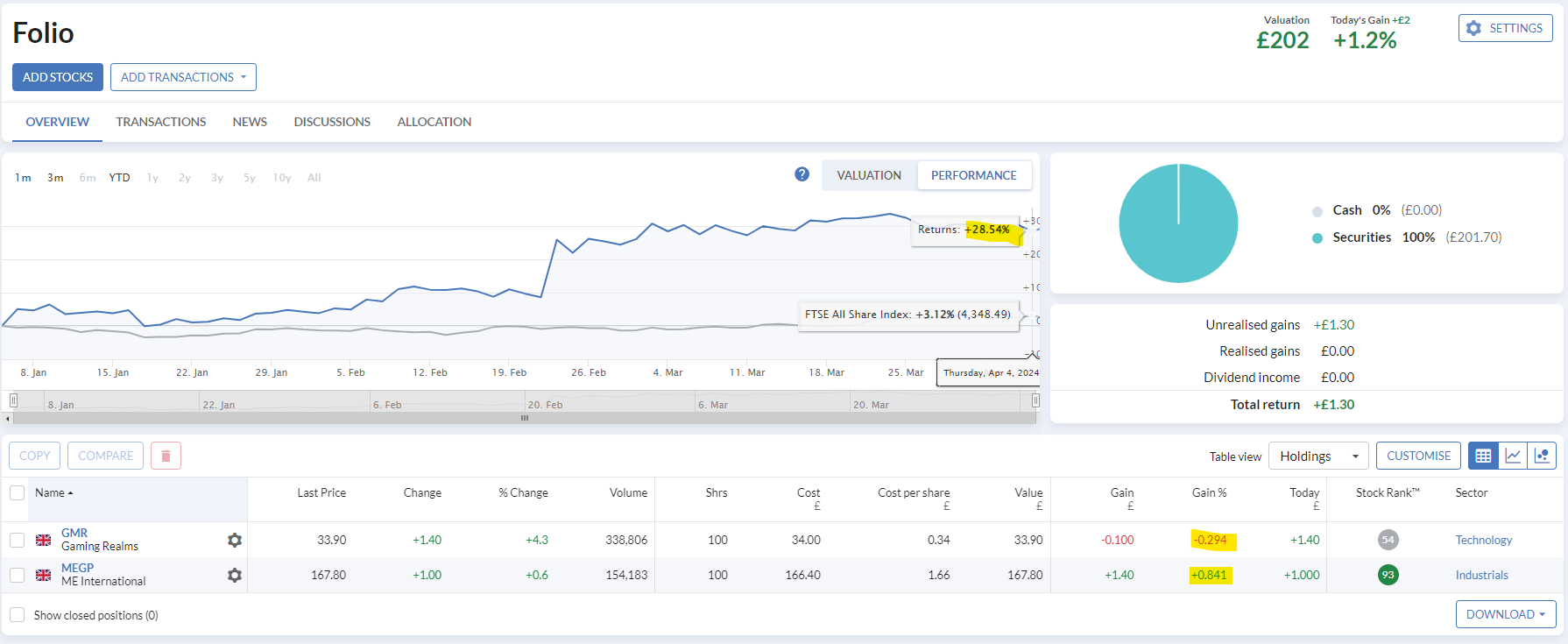

Stockopedia’s Folios tool allows for fast, in-depth analysis of a group of stocks - either ones you already own, or a watchlist of stocks you’re thinking of buying.

The Folio tool has been designed to help you avoid three of the most common risks when building and managing a portfolio of stocks:

1) Overconfident position sizing

Keep in mind that stocks which carry a heavier weighting in your portfolio, will also have an outsized impact on your portfolio returns. Does your conviction in this position match with its size? In other words, are you convinced that a stock on which you are overweight will help drive the returns of your portfolio?

2) Owning only speculative stocks

Diversification across different styles of investing matters. You might not be aware that your portfolio is made up of predominately speculative bets which are all at the risk of massive underperformance.

3) A lack of sector diversity

Portfolio diversification is a subject that divides opinion, and it’s one that most investors approach by thinking in terms of numbers. It ends up being a balancing act between offsetting the risk of single failures against the costs and effort of managing dozens of positions.

You can find out more about all three of these risks in our brand new guide on portfolio analysis. Follow this link to our Academy to read it.

25 Folios for everyone

We’ve heard for a long time that our community would like more than 10 Folios - for creating watchlists, testing strategies, tracking your family’s investments, and more. Thanks to the infrastructure improvements that we have made recently, we are now in a position to expand everyone’s Folio limit.

Regardless of your plan, you can now create up to 25 Folios (up from 10 previously).

You do not need to do anything in order to benefit from this, all changes have already been reflected on your account.

In order to make the most of these additional Folios, we have also put together two new guides in the Academy to help with your portfolio management.

1) Monitoring your potential investments with watchlists

Watchlists are a useful tool to help you keep track of your investment ideas and ensure a healthy, growing portfolio. In this article series we’ve shown how you can use our watchlist tool to help keep your focus and also to improve diversification efforts in different geographies.

We know most of you already have at least one portfolio, but perhaps you are thinking of setting up a new portfolio or maybe you are looking to tweak your existing portfolio to better align with the principles of healthy portfolio building. This guide takes you through those principles step-by-step.

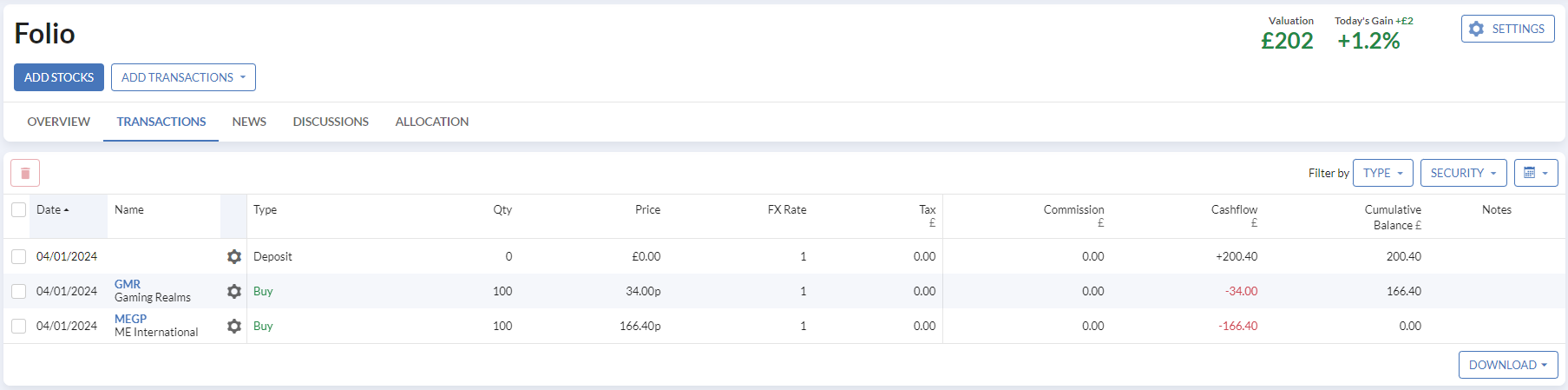

Easier analysis and management of multiple Folios with improved exports

Stockopedia has long had the ability to export transactions so you could analyse your Folios in spreadsheets, and combine multiple folios in one spreadsheet.

Unfortunately however, the export format wasn’t easily importable back into Stockopedia. This meant that it was harder than we’d have liked to use Stockopedia’s powerful portfolio analysis tools to understand the performance and breakdown of multiple Folios in aggregate.

From now on, the download option in Transactions will export in a format that can quickly and easily be imported back into Stockopedia. This allows you to create and update a Folio containing a high-level overview of all your investments.

Fear not if you were using the old format in your own analysis - the previous format has been maintained in the options marked as legacy.

For more experienced Folio users, we hope that this enables you to get even more utility out of Stockopedia’s powerful Folio features. If you haven't yet created a Folio, please see our guide for further details on getting started and to learn more about the value of Folios for monitoring your investments, our orientation webinar on the Stockopedia Academy can help (the Folios section starts at 24:15).